The Centaur Weekly | AI acceleration, geopolitical risks, and economic disruptions are converging at the same time. This newsletter, curated by Cenk Sidar, breaks down the major news, analyzes why it actually matters, and highlights the risks and opportunities shaping power, markets, and technology.

Post-Maduro Venezuela

The United States has carried out a direct military operation in Venezuela, capturing President Nicolás Maduro and removing him from power. The action followed months of escalating pressure, including maritime interdictions, oil tanker seizures, and covert operations. President Trump framed the strike as a law-enforcement mission tied to Maduro’s U.S. indictments for narcotrafficking. He ruled out a full-scale occupation but said the United States would oversee the country during a transition. Congress was not consulted, and the legal basis remains unclear. Governments across Latin America are preparing for instability, migration pressure, and uncertainty over who governs next in Caracas.

This operation reveals the defining feature of Trump’s foreign policy: action without doctrine. It is neither isolationism nor classic interventionism. It is selective force, applied where the optics are clean, the military risk is low, and the consequences can be postponed. The logic is simple. Act decisively in places the U.S. considers its backyard. Avoid long commitments elsewhere. Signal strength without committing to rules. This is spheres-of-influence politics, stripped of ideology.

Trump’s language matters. Invoking a so-called “Donroe Doctrine” and suggesting the U.S. will “run the country” openly discards sovereignty norms. Doctrines are meant to anchor power to principles. Here, there are none. Power stands alone. That creates unpredictability. Allies are left guessing. Adversaries are forced to assume the worst. That combination raises the risk of miscalculation.

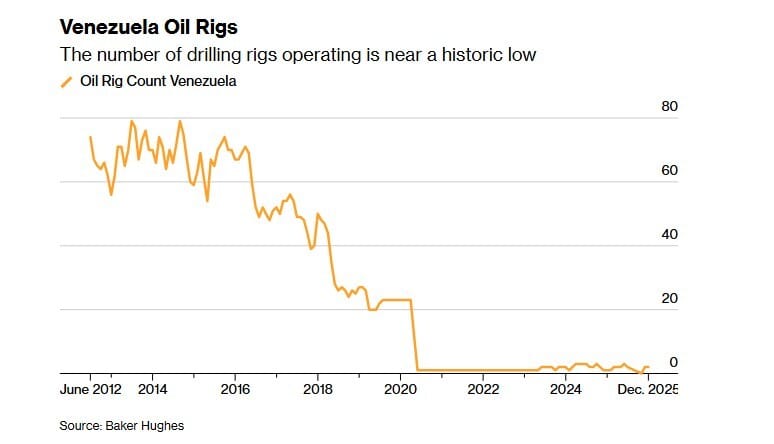

For markets, the immediate impact is volatility. The oil story, however, is misunderstood. Venezuela cannot ramp production quickly. Its fields need capital, technology, and legal clarity. If Venezuelan oil ever returns at scale, it would push global prices down—hurting U.S. shale producers and domestic energy margins. That is the contradiction investors must price: regime change abroad that could undercut energy producers at home. Anyone expecting fast sanctions relief or quick production gains is misreading both the economics and the politics.

Iran Unrest Escalates

Protests driven by inflation, currency collapse, and falling living standards have entered their second week across major Iranian cities. At least 16 people have been killed and hundreds arrested as security forces crack down. What began as economic anger has evolved into political demands, making this the most serious unrest since 2023. Supreme Leader Ayatollah Khamenei has rejected concessions, while hardliners blame foreign interference.

Tehran is not viewing Venezuela as a regional exception. It sees a precedent.

The message Iran is absorbing is blunt: leadership immunity is no longer guaranteed. When combined with Israel’s dismantling of Iran’s air defenses and U.S. strikes on nuclear facilities, the Maduro operation punctures a long-held Iranian assumption—that escalation would stop short of regime-level consequences.

The psychological shock matters more than the military one. This is power politics without stabilizing rules. Trump’s signal is transactional, not ideological: the U.S. will act where it can win fast and cheaply. That does not create deterrence. It creates ambiguity.

Iran is unlikely to respond with restraint or surrender. The more probable response is dispersion of risk calibrated provocations, asymmetric signaling, and tighter internal repression. When regime survival becomes the overriding priority, normal deterrence logic breaks down. For policymakers and markets, that means higher odds of miscalculation and a structurally higher level of geopolitical risk.

Can you scale without chaos?

It's peak season, so volume's about to spike. Most teams either hire temps (expensive) or burn out their people (worse). See what smarter teams do: let AI handle predictable volume so your humans stay great.

Newsletter Boom Reshapes Media Economics

The newsletter economy crossed a threshold in 2025, evolving from a creator niche into a scalable media business. Platforms such as Substack and Beehiiv are attracting journalists, investors, celebrities, brands, and legacy publishers seeking direct audience relationships. Substack reports roughly 5 million paid subscriptions, up sharply year over year. Beehiiv nearly doubled revenue to $28 million and expanded beyond newsletters into websites, advertising, and podcasts. Major outlets, including The New Yorker and The Wall Street Journal’s opinion section, are now treating newsletters as core growth products amid collapsing traffic from Google and Facebook. As AI reshapes search and platforms retreat from news, newsletters are becoming a defensive asset in the attention economy.

This is not a format shift. It is a power shift. Newsletters monetize credibility at a time when institutions are losing trust and content is infinite. Authority has moved away from logos and toward individuals.

In an AI-flooded media environment, information is no longer scarce. Credibility is. Newsletters sell that scarcity directly. There is also a hard strategic logic at work. Google’s AI summaries and Meta’s withdrawal from news have exposed how fragile traffic-based media models are. Newsletters reverse that dependency. They offer predictable revenue, first-party data, and direct pricing power.

For markets, newsletter platforms are quietly becoming media infrastructure. The winners will not simply be good writers. They will be operators—people who combine a clear point of view, disciplined distribution, and sophisticated monetization. The boom is real. So will be the shakeout.

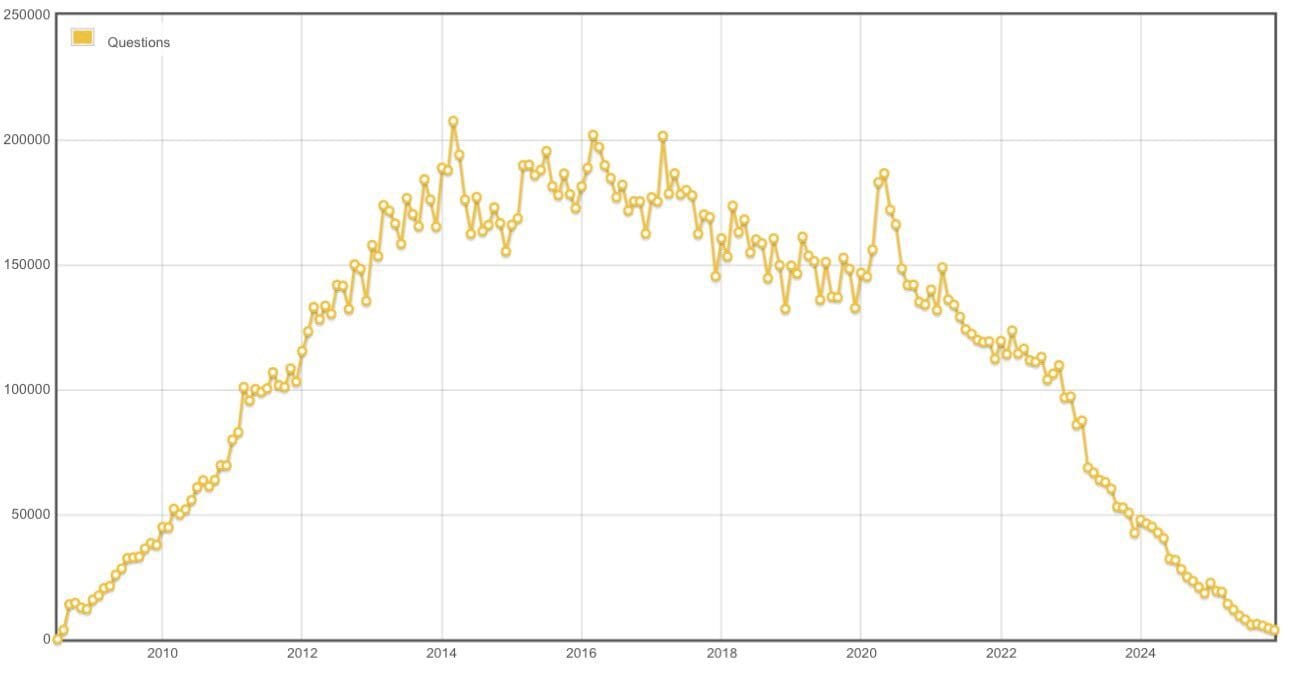

Posts to Stack Overflow, the once-dominant forum where programmers publicly asked and answered technical questions, have declined sharply. Routine debugging and coding queries that once fueled open discussion are increasingly handled privately through AI chatbots. The shift is hollowing out a key public knowledge commons, as problem-solving moves from searchable forums to closed, one-on-one interactions.

🧠 Centaurs, Canaries, and J-Curves: Pitfalls and Productivity Potential of AI

A clear-eyed framework for understanding how AI actually reshapes work. The piece distinguishes between centaurs (humans augmented by AI), canaries (early losers of automation), and the J-curve of productivity—short-term disruption before long-term gains. Essential reading for separating hype from real economic impact. Also highlighting our Centaur Concept :0)

📈 Capital in the 22nd Century

Philip Trammell examines how AI changes the nature of capital itself—shifting value from traditional assets toward systems, coordination, and leverage over intelligence. A forward-looking meditation on power, ownership, and returns in an AI-saturated economy.

⚠️ Generative AI’s Crippling and Widespread Reliability Problem

Gary Marcus lays out the structural reasons large language models continue to fail in systematic ways. This is not a critique of bad prompts or early-stage bugs, but of fundamental limitations that matter for policy, enterprise adoption, and trust.

🔒 Why ChatGPT Can’t Be Trusted With Sensitive Tasks

A sober warning about deploying generative AI in high-stakes domains. Marcus details why confidence, fluency, and scale mask deep reliability and governance risks—especially where errors are costly or irreversible.