The Centaur Weekly | AI acceleration, geopolitical risks, and economic disruptions are converging at the same time. This newsletter, curated by Cenk Sidar, breaks down the major news, analyzes why it actually matters, and highlights the risks and opportunities shaping power, markets, and technology.

Nvidia Stroke Deal with Groq

Nvidia announced on Christmas Eve a licensing deal with AI startup Groq (not Musk's Grok) that will allow the chipmaker to integrate Groq’s chip technology into Nvidia products. Groq will remain an independent company with a new chief executive, while several of its top executives, including founder and CEO Jonathan Ross, will join Nvidia to help incorporate the technology into its product roadmap. The arrangement is valued at roughly $20 billion and includes substantial payouts to Groq shareholders and employees. By gaining access to Groq’s ultra-fast chips, Nvidia is expanding its capabilities in real-time AI inference and opening new market opportunities as competition in advanced AI hardware intensifies.

This is a non-acquisition acquisition. Labeling it a licensing agreement is a legal maneuver meant to limit antitrust exposure, following the same pattern as Meta’s Scale AI deal and Google’s recent acqui-hires. For Nvidia, the price is immaterial. Strategically, it may be the most important deal in the company’s history. The first reason is inference. Nvidia dominates general-purpose AI compute, but that position came under pressure when Google began deploying—and selling—its own TPUs. The key figure here is Groq founder and CEO Jonathan Ross, a former Google chip executive and one of the original architects of the TPU. Groq began as his 20% project at Google and later evolved into LPUs, ultra-fast, low-latency, low-cost inference chips. Inference is where AI value is shifting.

Small Language Models is the area where competition will intensify, as I argued in my previous analysis. What was once seen as Nvidia’s vulnerability is now directly addressed. The second reason is CUDA. Nvidia’s real moat is not hardware alone but its developer platform. Integrating Groq extends CUDA across the full AI stack, from training to inference, while Nvidia’s access to TSMC capacity and global distribution gives Groq scale it could never reach independently. The deal also stalls Google’s momentum in specialized AI hardware by aligning Nvidia with the person who helped invent the TPU. It is an acquisition in everything but name.7963

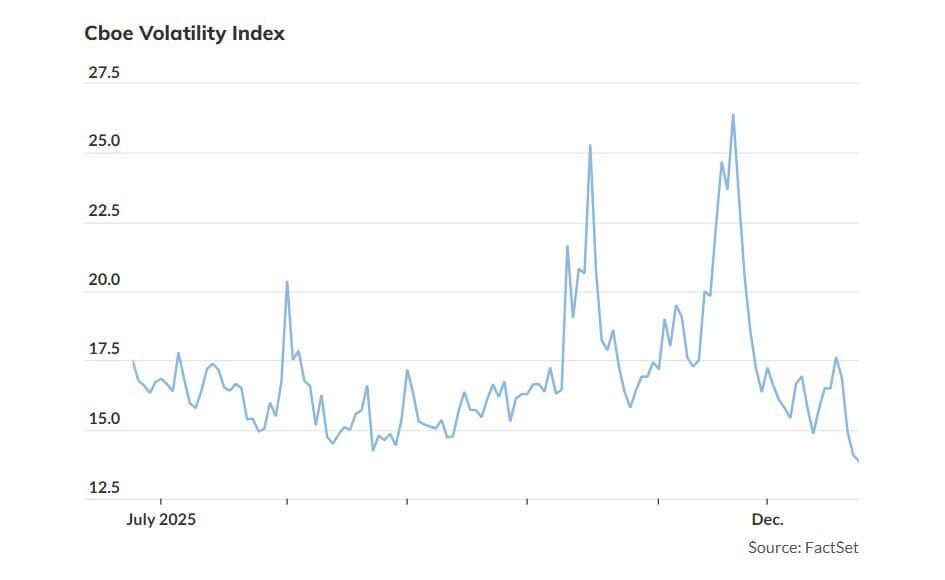

Normalizing the Volatility in the Markets

Implied volatility in U.S. equity markets has collapsed to levels not seen in decades, even as realized volatility has remained elevated. The Cboe Volatility Index (VIX), often called Wall Street’s “fear gauge,” is trading below 14 and set to finish 2025 near its lowest annual reading since its inception in 1990, according to Dow Jones Market Data. Earlier in the year, in April, the VIX spiked above 52 its highest end-of-day level since April 2020 reflecting heightened market turbulence before the recent decline in volatility expectations.

The collapse in implied volatility does not mean risk has disappeared. It means risk is being priced out. At the same time, realized volatility is rising and hedging activity remains elevated. This combination is historically unstable.

The calm also sits uneasily with the political and economic backdrop. Major geopolitical risks remain unresolved, from ongoing wars to U.S.–China tensions over technology and supply chains. The AI trade is no longer a one-way bet. Competition is intensifying, capital spending is rising, and uncertainty over winners and losers is growing. Markets are pricing confidence while fundamentals are pricing friction.

Add structural pressure from the labor market slowing hiring, rising white-collar unemployment, and AI-driven disruption and the gap becomes clearer. Volatility is not going away in 2026. It is being postponed. Volatility is likely to be higher, sharper, and more frequent than what markets have grown used to this year.

The Future of AI in Marketing. Your Shortcut to Smarter, Faster Marketing.

Unlock a focused set of AI strategies built to streamline your work and maximize impact. This guide delivers the practical tactics and tools marketers need to start seeing results right away:

7 high-impact AI strategies to accelerate your marketing performance

Practical use cases for content creation, lead gen, and personalization

Expert insights into how top marketers are using AI today

A framework to evaluate and implement AI tools efficiently

Stay ahead of the curve with these top strategies AI helped develop for marketers, built for real-world results.

A decade ago, software development was considered one of the safest careers in the modern economy. Governments, NGOs, and universities invested heavily in STEM programs. That assumption has not aged well. Software developers are now becoming obsolete faster than many other jobs. The shift is not gradual; it is structural. I do not have a formal software background. I experimented with BASIC on a Commodore 64 as a child, but I never learned coding. This weekend, using the new Lovable.dev, I built two fully functioning applications. Not demos, not prototypes working products. The ease of execution was striking. One is an OKR and task management system, already live. The broader implication is clear: the barrier to building software has collapsed. Technical expertise is no longer the primary constraint. This shift will quietly but profoundly reshape entrepreneurship, labor markets, and who gets to participate in the digital economy.

📺Niall Ferguson lecture on the Future of the West

A wide-ranging conversation on geopolitical fragmentation, declining institutional trust, and the long-term implications for Western power. A long but definitely worthwhile.📺Kevin Hassett on the Future of the Federal Reserve (WSJ)

Hassett, a forerunner for the Fed chair, outlines how monetary policy may adapt to persistent inflation risk, fiscal pressure, and political constraints.🌐 13 Cultural Predictions for 2026 – Bloomberg

From declining alcohol consumption to the reshaping of media, sports, and wearables, this is a useful snapshot of how cultural behavior is shifting beneath macro headlines. Culture often moves before markets notice.