The Centaur Weekly | AI acceleration, geopolitical risks, and economic disruptions are converging at the same time. This newsletter, curated by Cenk Sidar, breaks down the major news, analyzes why it actually matters, and highlights the risks and opportunities shaping power, markets, and technology.

China’s $1 Trillion Surplus Becomes a Geopolitical Fault Line

China’s annual trade surplus has surpassed $1 trillion, the largest on record, underscoring the country’s deepening reliance on exports as domestic demand remains weak. Exports to Europe and Southeast Asia have offset declining shipments to the United States, while imports have lagged due to subdued consumer spending and a fragile property sector. The scale of the surplus has drawn sharp warnings from international institutions. The IMF and several G7 governments have flagged the risk of renewed global trade tensions, arguing that China’s export-heavy growth model is amplifying global imbalances at a moment when advanced economies are politically and economically less willing to absorb them.

China’s $1 trillion surplus is not a sign of strength; it is a signal of strategic imbalance. It reflects an economy that has failed to rebalance toward domestic consumption and is instead exporting its excess capacity to the rest of the world. This matters because the global system is no longer configured to absorb China’s output without political consequences. In the U.S. and Europe, industrial policy, election-year politics, and national security concerns are converging. Large trade surpluses now translate directly into tariffs, investigations, and capital restrictions.

Beijing’s constraint is structural, not tactical. Pushing consumption threatens financial stability; curbing exports threatens employment and social control. There is no clean adjustment path. The more likely outcome is escalation rather than rebalancing. Over the next year, trade friction will extend beyond the U.S.–China corridor into Europe, emerging markets, and politically sensitive sectors such as green technology and industrial manufacturing. China’s surplus is no longer an accounting artifact; it is a force multiplier for fragmentation in an already stressed global system.

Oil’s Geopolitical Premium Is Breaking Down

Global oil prices have remained unexpectedly subdued despite escalating geopolitical tensions, as evidence mounts of a significant supply glut forming offshore. An estimated one billion barrels of crude are currently stored at sea, well above seasonal norms, reflecting excess production from OPEC+, rising output from the U.S. and Brazil, and constrained flows of sanctioned Russian and Iranian oil. Demand growth, particularly from China and Europe, has failed to keep pace. As a result, markets are discounting geopolitical risk and pricing oil more as an oversupplied industrial commodity than a scarcity-driven strategic asset.

Stagnant oil prices are not a vote of confidence in stability; they are a warning about demand. In previous cycles, geopolitical tension alone was enough to lift crude prices. Today, even sanctions, Middle East risk, and U.S.–Venezuela friction struggle to move the market. That tells us two things. First, supply discipline has weakened OPEC’s ability to manage prices is eroding. Second, global demand is softer than headline growth numbers suggest.

This has second-order consequences. Energy-exporting states will face fiscal pressure sooner than expected. Inflation hedges tied to commodities may underperform. And central banks may find that disinflation persists longer than their models assume, complicating policy normalization. The oil market is signaling a world where growth is slower, trade is more fragmented, and geopolitical risk no longer guarantees economic leverage. That is a fundamentally different macro regime — and one investors are still underpricing.

Generative AI Reshapes Work: McKinsey’s Layoff Plan Highlights White-Collar Risk

McKinsey & Company is planning significant reductions among its non client facing staff, with cuts of up to 10% in some functions, Bloomberg reported. The measures could result in the elimination of several thousand roles over the next 18 to 24 months, according to people familiar with the matter. The move comes as the consulting industry faces a period of uneven adjustment. After several years of rapid hiring that expanded McKinsey’s workforce to more than 45,000, growth in fees has slowed. Headcount has since fallen to about 40,000, and utilization rates across the sector have declined as corporate clients rein in spending, postpone advisory projects, and increasingly turn to automation and artificial intelligence in place of traditional consulting services.

McKinsey’s planned job cuts are a leading indicator of where white-collar work is headed, not a one-off consulting adjustment. Generative AI is collapsing the economic value of much of what analysts, associates, and junior managers have historically done: information gathering, synthesis, modeling, and presentation. These were never scarce skills. They were just expensive. AI turns them into commodities overnight. The result is a brutal repricing of white-collar labor, especially in professions that scaled through leverage rather than ownership or hard assets.

This shift creates a growing structural disconnect inside elite firms. Partners will remain highly compensated, closer to clients, and positioned as judgment and relationship capital, while the traditional analyst pipeline thins or breaks altogether. Fewer people will move up, fewer will be trained, and the apprenticeship model that once justified long hours and delayed rewards will weaken.

OpenAI Releases ChatGPT 5.2

OpenAI last week announced the release of GPT-5.2, calling the artificial-intelligence model its most advanced for professional knowledge work. The release comes about a week after Chief Executive Sam Altman declared a “code red” effort to improve the quality of ChatGPT and to delay development of some other initiatives, including advertising. The company has been on high alert from the rising threat of Google’s latest Gemini AI model, which outperformed ChatGPT on certain benchmarks including expert-level knowledge, logic puzzles, math problems and image recognition.

The release of ChatGPT 5.2 should be understood less as a breakthrough and more as a positioning move in the intensifying contest for knowledge-worker platforms. From an industry perspective, OpenAI is signaling that the battleground has shifted from consumer delight to enterprise reliability: accuracy, workflow integration, and consistency now matter more than personality or novelty. In that sense, 5.2 is designed to reassure corporate buyers and CIOs that OpenAI is prioritizing controllability and scale particularly as Google’s Gemini aggressively courts the same customers with deep integration into productivity software.

The mixed reception matters precisely because it exposes a fault line in the AI industry. As models become more powerful, they also become more constrained, standardized, and enterprise-safe often at the expense of perceived creativity or responsiveness. That trade-off is not accidental; it reflects where the real money is. The race is no longer about which model feels smartest in a chat window, but about which platform becomes embedded in the daily operating layer of firms employing millions of knowledge workers. From that vantage point, ChatGPT 5.2 is not a retreat it is OpenAI choosing discipline over spectacle as the industry enters its consolidation phase.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

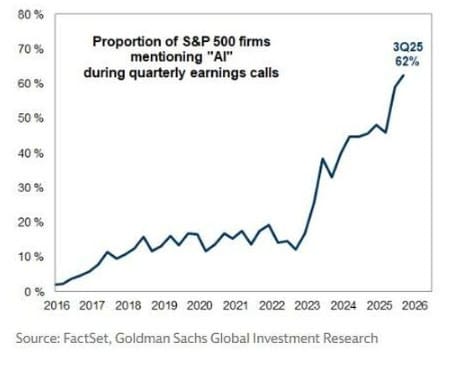

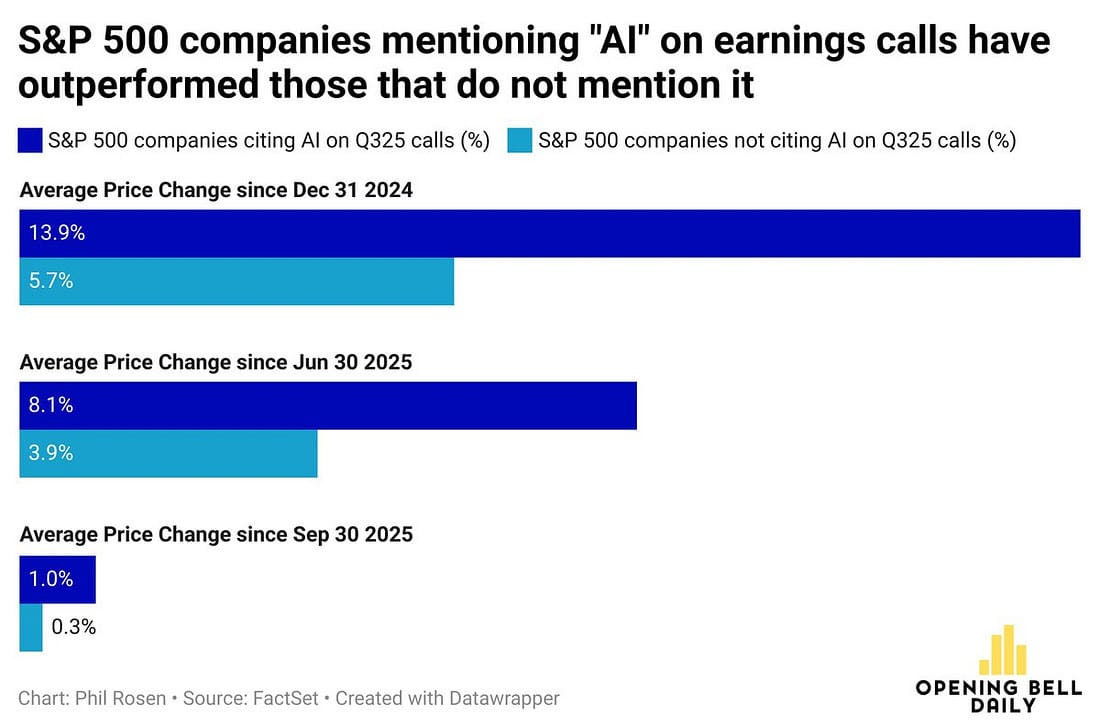

The fact that nearly two-thirds of S&P 500 companies now mention AI on earnings calls is less a measure of adoption than of incentive alignment. Earnings calls are narrative instruments, not technical disclosures, and AI has become the most efficient way to signal relevance, ambition, and future optionality to capital markets. This is what a hype cycle looks like when it matures: the technology is real, the upside is large, but the language becomes compulsory.

Once mentioning AI is table stakes, silence is interpreted as strategic drift. The result is a market that rewards intent before execution and optimism before proof. What’s more revealing is where the AI talk thins out. Asset-heavy sectors like energy, materials, and real estate where AI could drive genuine productivity gains are underrepresented because they don’t benefit as immediately from narrative inflation. As returns normalize, the premium will shift from saying “AI” to demonstrating it, and the winners will be the companies that used the hype phase to quietly build real advantage while others were busy polishing slides.

• 🧠 A Foreign Policy analysis on the evolving role of USAID and U.S. foreign assistance, offering a clear take on how geopolitics, great-power competition, and aid strategy are intersecting in Southeast Asia.

• 🧠 A deep dive into Instrumental Capital and Gulf sovereign wealth strategies, illuminating how sovereign funds are recalibrating their role in tech and AI ecosystems as geopolitical risk rises.

• 📺 A The Information investigative piece that examines unusual Polymarket betting activity tied to OpenAI and Google, raising questions about insider information and market signals in AI competition.

• 🧠 A sharp, reflective essay on how thinkers should balance solitude and AI augmentation — a philosophical yet practical perspective for leaders navigating the tech-driven knowledge economy.